Crypto Futures No Kyc

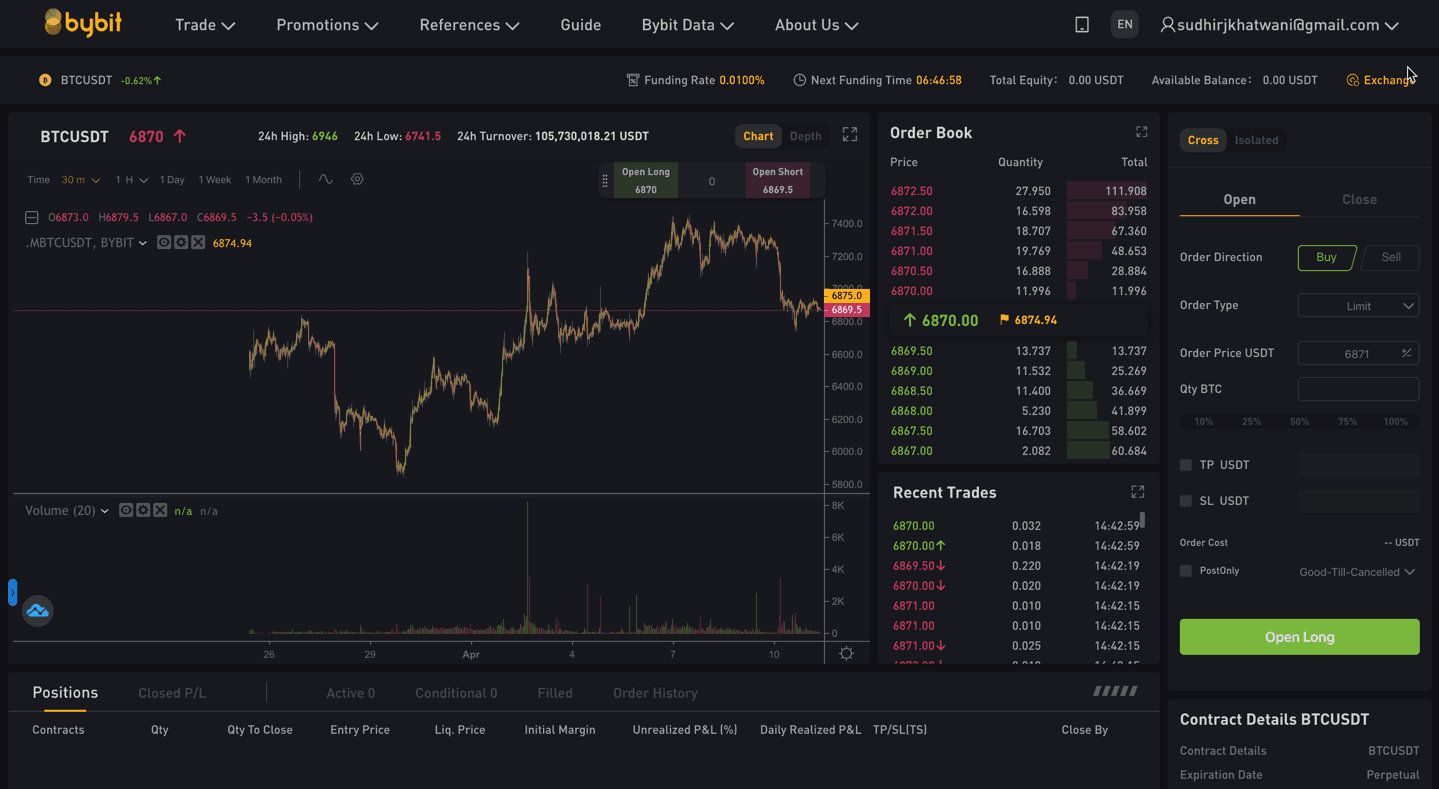

Crypto Futures No Kyc. Crypto enthusiasts believe the platform could grow exponentially with the introduction of KYC procedures, but the derivatives futures exchange platform is yet to put these measures in place. KYC (Know Your Customer) guidelines are a prominent feature in financial systems.

The process is mandatory for banks, lenders, insurance providers, and other financial and monetary companies of all sizes.

Good part of the world knows what crypto is and that crypto exchanges exist - including law enforcement and other authorities.

Crypto futures provide a way for traders to get exposure to cryptocurrencies like Bitcoin and Ethereum, without having to hold the underlying asset. Granted, it is hard to justify requiring KYC checks for most wallets as they are essentially pieces of "It was notable that the majority of crypto exchanges and wallets do not have proper KYC procedures All CFDs (stocks, indexes, futures) and Forex prices are not provided by exchanges but rather by. This is good news for investors who prefer to stay anonymous, but.

0 Response to "Crypto Futures No Kyc"

Posting Komentar